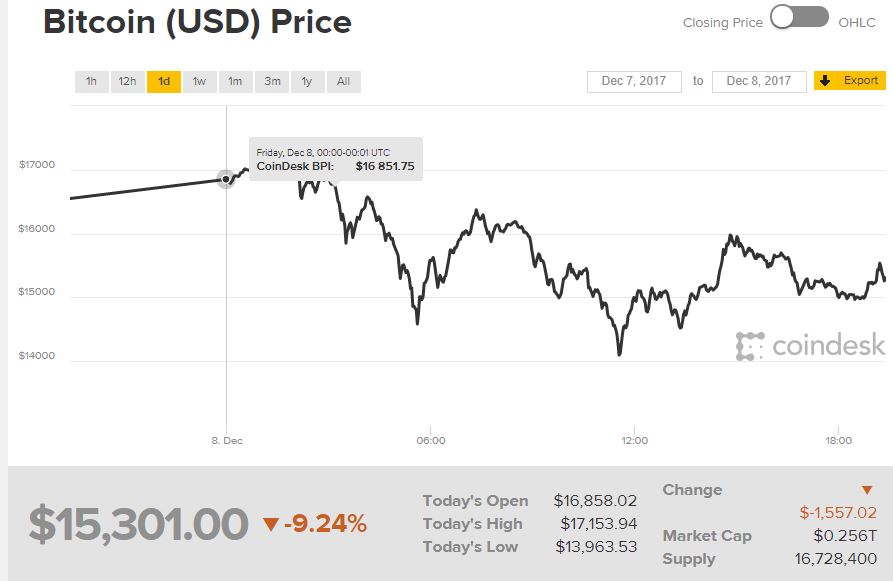

The Bitcoin roller-coaster is continuing to amaze the world. This week was absolutely terrific for the Bitcoin bulls, as the cryptocurrency surged passed a whopping $19000, before making a correction and going under $15,000. Now it’s currently back up over the $17,000 mark. Bitcoin price will continue to make new records because the currency is getting traction and fame around the world. Despite several warnings from bank and a few investors, Bitcoin is breaking all barriers.

The Threat of Bitcoin Futures

Perhaps the biggest decisive moment for Bitcoin is on Sunday as two major exchanges, CBOE and CME, are set to initiate Bitcoin futures. Bitcoin options futures will allow traders to buy and sell Bitcoin easily. While this step is a major win for Bitcoin, some analysts warn that Bitcoin price will crash after futures because hedge funds and big banks will be able to short Bitcoin easily. So far, hedge funds have issued warnings regarding the future of Bitcoin. It was not easy to short or bet against Bitcoin. But Bitcoin trading as an option means that hedge funds can spend millions to bet against Bitcoin. This will induce a lot of volatility in the cryptocurrency.

Banks are obviously not happy about Bitcoin futures. Futures Industry Association (FIA) chief executive Walt Lukken recently wrote an open letter to Commodity Futures Trading Commission, blasting the commission authorities on their decision to start offering Bitcoin futures. Lukken thinks that the global markets are not yet “ready” for Bitcoin futures. Ready or not, the futures could be a curse in disguise for Bitcoin.

Lou Kerner, an expert at a Venture Capital firm recently said in a report that Bitcoin is the “biggest shorting opportunity” ever. Bloomberg recently published a report on the effects of Bitcoin futures on Bitcoin price. The report quotes Michael Moro, the CEO of Genesis Global Trading, which has lent over $20 million to investors to help them bet against Bitcoin. Moro says that Bitcoin futures will make it easy for his clients to bet against the cryptocurrency. As a result, short interest in Bitcoin will rise.

Craig Pirrong, a professor at the University of Houston, thinks that futures slash the “frictions” of going short on Bitcoin. Bitcoin futures will become a key instruments using which major banks like Goldman Sachs, JPMorgan, Warren Buffett will bet against the cryptocurrency.

==============================================================

What we’re all about at Ace Poker Solutions

We offer the highest EV poker software, and training tools available on the net, recommended and used by today’s top poker players are the world. We’ve been doing this since 2009 with the emphasis on offer unique and creative poker software that will help any level of poker player be a more thoughtful and successful player at the table. We’d invite you to check these titles out:

Leak Buster Software – Leak Buster is poker software that interfaces with your Holdem Manager or Poker Tracker database, and extracts key statistics about your play in order to find your largest poker leaks. It’s unique scoring algorithm weighs the impact of your leak against average win-rates, and suggests ways to correct those leaks through the use of videos (over 50) and written modules.

Leak Buster Software – Leak Buster is poker software that interfaces with your Holdem Manager or Poker Tracker database, and extracts key statistics about your play in order to find your largest poker leaks. It’s unique scoring algorithm weighs the impact of your leak against average win-rates, and suggests ways to correct those leaks through the use of videos (over 50) and written modules.

DriveHUD – DriveHUD is a poker database and HUD for your online poker play. It will overlay a HUD on your online poker tables, and display vital stats about each of the opponents on your table. It will track and record all of the hands you play online, allow to you to review, re-play, filter, graph and analyze all of the hands you’ve played so you can improve your poker game.

DriveHUD – DriveHUD is a poker database and HUD for your online poker play. It will overlay a HUD on your online poker tables, and display vital stats about each of the opponents on your table. It will track and record all of the hands you play online, allow to you to review, re-play, filter, graph and analyze all of the hands you’ve played so you can improve your poker game.

Ace Poker Drills – Ace Poker Drills is a poker training software that gives you a “flash card” style training for Odds and Outs, Equity, and Pre- Flop play. The Pre-Flop trainer will help you to easily recognize which hands to play in different positions. Odds and Outs trainer will get you to quickly calculate your odds and outs in various situations. Equity Trainer will quiz you on equity calculations for different hands, so that knowing your equity in a given scenario will be.

Ace Poker Drills – Ace Poker Drills is a poker training software that gives you a “flash card” style training for Odds and Outs, Equity, and Pre- Flop play. The Pre-Flop trainer will help you to easily recognize which hands to play in different positions. Odds and Outs trainer will get you to quickly calculate your odds and outs in various situations. Equity Trainer will quiz you on equity calculations for different hands, so that knowing your equity in a given scenario will be.

Leave A Comment

You must be logged in to post a comment.